Water & Wastewater Treatment Equipment Industry | Cutting-Edge Tech Cleaning Up Our Wastewater

Global water & wastewater treatment equipment industry database, published by Grand View Research’s is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

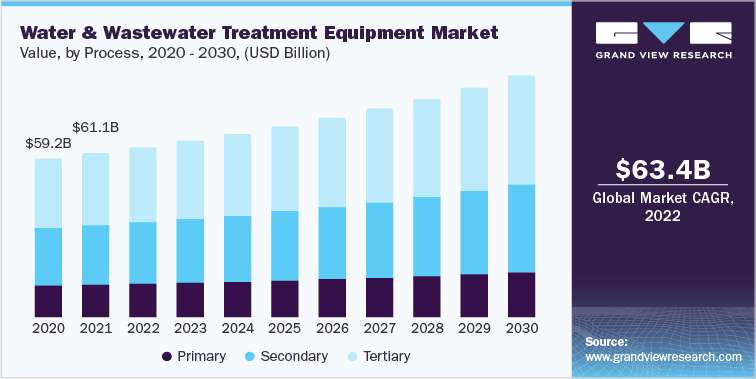

The economic value generated by the water & wastewater treatment equipment industry was estimated at approximately USD 63.4 billion in 2022. The demand for clean water is significantly increasing across the world owing to increasing agriculture and industrial activities. The clean water reservoirs are depleting fast due to the increasing water withdrawals from groundwater and surface water along with rising global warming. This is expected to increase the demand for water & wastewater treatment equipment over the forecast period.

Access the Global Water & Wastewater Treatment Equipment Industry Data Book from 2023 to 2030, compiled with details by Grand View Research

Primary Water & Wastewater Treatment Equipment Market Analysis & Forecast

The global primary water and wastewater treatment equipment market size was estimated at USD 12.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. Rising awareness regarding water pollution and environmental degradation is anticipated to boost the demand for wastewater management plants, thereby augmenting the market growth. The construction of new housing projects is predicted to increase quickly, and the number of people utilizing centralized sludge management systems is expected to rise. These factors are expected to boost the demand for primary water and wastewater treatment equipment. Additionally, it is anticipated that capacity expansion and the development of new production facilities will have a beneficial impact on market growth.

The demand for primary treatment for industrial discharge and waste is expected to be driven by the stringent regulations enforced by the national governments, along with rising awareness regarding water and sludge management. Governing authorities in various countries are funding R&D for water and wastewater treatment, which is expected to fuel market growth. In addition, companies are also trying to develop systems to increase primary treatment capacities where there is limited or less space or cost considerations to install more advanced treatment equipment. The use of primary treatment equipment such as screens or grit chambers is expected to grow in rural areas, especially in African countries where awareness about sewage treatment is beginning to grow.

Secondary Water & Wastewater Treatment Equipment Market Analysis & Forecast

The global secondary water and wastewater treatment equipment market size was estimated at USD 23.3 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 4.3% from 2023 to 2030. The primary drivers of this market growth are rising water pollution levels in developing nations like Korea, India, China, Japan, and Malaysia, as well as rising concerns about water scarcity and the need for freshwater resources due to rapidly growing urbanization.

The demand for clean water is significantly increasing across the world owing to increasing agriculture and industrial activities. The clean water reservoirs are depleting fast due to the increasing water withdrawals from groundwater and surface water along with rising global warming. This is expected to lead to increased demand for secondary water & wastewater treatment equipment over the forecast period. Global oil & gas production is likely to witness significant growth from non-OPEC countries and developing countries. Growing demand for energy, shale gas, tight gas, and coal bed methane (CBM) on account of the maturity of the conventional oil & gas resources market is expected to be a major driver triggering the growth of the secondary water & wastewater treatment equipment industry.

The global refinery output was 75,222 thousand barrels per day in 2010, which reached 79,229 thousand barrels per day in 2021. This is driven by the increasing demand for oil-based fuels due to high industrial growth. Strong demand from refineries has been one of the major drivers for the secondary water and wastewater treatment equipment industry. The trend is anticipated to continue over the forecast period. Increasing investments in the exploration and production activities by the oil & gas companies in the U.S. are anticipated to boost the demand for secondary water and wastewater treatment equipment in the oil & gas industry. The rising number of infrastructure upgrades, in terms of changing or the installation of new pipelines, is expected to have a positive impact on the growth of the market.

Order Free Sample Copy of Water & Wastewater Treatment Equipment Industry Data Book published by Grand View Research

Tertiary Water & Wastewater Treatment Equipment Market Analysis & Forecast

The global tertiary water & wastewater treatment equipment market size was estimated at USD 27.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The market growth is driven by factors such as rising urbanization, rapid population growth, the rising need for clean water resources, and the increasing frequency of waterborne diseases. Furthermore, the growing demand for energy-efficient and advanced technologies is anticipated to propel the market growth over the forecast period.

Tertiary treatment is used as the final cleaning step for water before it is reused, recycled, or discharged into the environment. The residual inorganic compounds and pollutants, bacteria, viruses, and parasites are eliminated during this procedure, making the water suitable for reuse.The market is expected to benefit from increasing demand for activated carbon for eliminating residual hazardous compounds in wastewater. These factors are expected to propel the growth of the industry in the coming years. For instance, in November 2020, Koch Separation Solutions acquired RELCO, which offers cutting-edge process technologies for the dairy and food & beverage industries. This strategy was intended to expand the company’s scope of capabilities in the dairy and food & beverage industries.

Furthermore, the Brihanmumbai Municipal Corporation invited tenders for its advanced tertiary treatment plant project in September 2022, with the goal of recycling and reusing effluent water for potable uses. Photocatalytic degradation methods have been extensively used in recent years to eliminate organic contaminants in wastewater and effluents. As a developing destruction technique, advanced oxidation processes (AOPs) have been developed, resulting in the complete mineralization of the majority of organic pollutants. These factors are expected to drive the demand for tertiary water & wastewater treatment equipment.

Moreover, stringent government regulations such as the U.S. EPA and Clean Water Act related to wastewater emission, coupled with the launch of innovative tertiary clarifiers, are expected to drive the demand. For the primary, secondary, or tertiary clarity processes, turbidity removal, softening, or thickening applications, Ovivo offers dependable and robust mechanisms, such as the bioreactor-clarifier, to assure optimal performance. The biochemical oxidation of organic molecules in a contact-weighted load can be intensified using bioreactors-clarifiers for tertiary treatment of urban wastewater using dissolved technical oxygen. This results in the increased efficacy of wastewater treatment by BOD and other components.

Key players operating in the water & wastewater treatment equipment industry are –

• Evoqua Water Technologies LLC

• Pentair plc

• Ecolab Inc.

• DuPont

• Xylem, Inc.

• Calgon Carbon Corporation

• Toshiba Corporation

• Veolia Group

• Aquatech International LLC

• Ecologix Environmental Systems, LLC

• Evonik Industries AG

• Lenntech B.V.

• Parkson Corporation

Comments

Post a Comment